Do I Need Proof of Income to Buy a Car?

When you’re planning to buy a new or used car, one of the first things you’ll need to do is provide proof of income. This documentation verifies your ability to make the regularly scheduled loan payments. Lenders need reassurance that you’ll be able to meet your financial obligations and repay the loan on time.

What Is Proof of Income?

Proof of income generally comes in the form of official documents that provide evidence of your earnings. As technology evolves, some may be submitting electronic documentation from banks, investment institutions, or online paystub providers. Providing up-to-date financial information not only speeds up the approval process but allows the lender to offer the best loan terms available to you.

Why Do I Need Proof of Income?

Lenders use proof of income to assess your financial standing and determine your monthly debt-to-income ratio. This ratio measures the percentage of your gross monthly income that goes towards debt payments, including the new car loan. Lenders typically prefer a debt-to-income ratio below 36%, ensuring you’ll have enough wiggle room in your budget to fulfill your obligation.

What Are Acceptable Forms of Proof of Income?

For employees:

- Pay stubs for the last 30-60 days

- Letter from employer stating your name, position, salary, and employment duration

For self-employed individuals:

- Schedule C form from your most recent tax return

- Profit and loss statement

- Bank statements showing business income

For retirees:

- Social Security award letter

- Pension statements

- Annuity payment statements

What Are Other Factors That Affect Loan Approval?

In addition to proof of income, lenders will consider other factors when evaluating your loan application:

- Credit score: A high credit score indicates a history of responsible financial management.

- Down payment: A larger down payment can reduce your monthly loan payments

- Loan term: Longer loan terms result in lower monthly payments but higher total interest charges.

- Credit history: Lenders examine your credit reports to check for missed or late payments.

Tips for Getting Approved

- Improve your credit score: Pay off debts, reduce credit card balances, and dispute any errors on your credit report.

- Increase your down payment: Saving for a larger down payment reduces the amount you need to finance and improves your debt-to-income ratio.

- Shop around for the best interest rates: Compare loan offers from multiple lenders to find the lowest monthly payments that fit your budget.

- Get pre-approved for a loan: This will give you a better idea of the loan amount you qualify for and make the car shopping process more efficient.

Frequently Asked Questions

Q: Can I get a car loan without proof of income?

A: Most lenders require proof of income to approve a car loan. However, some lenders may offer special programs for borrowers with limited or no income.

Q: What if I have irregular income?

A: Provide documentation for the last 12 months of income to give the lender a clear picture of your earning capacity.

Q: How much proof of income do I need?

A: Most lenders require pay stubs or bank statements for the last 30-60 days, along with recent income tax returns or other documentation.

Conclusion

Providing proof of income is an essential part of securing a car loan. By understanding the requirements and preparing the necessary documentation, you can increase your chances of loan approval and get behind the wheel of your dream car sooner.

Are you interested in learning more about the car buying process and how to obtain proof of income?

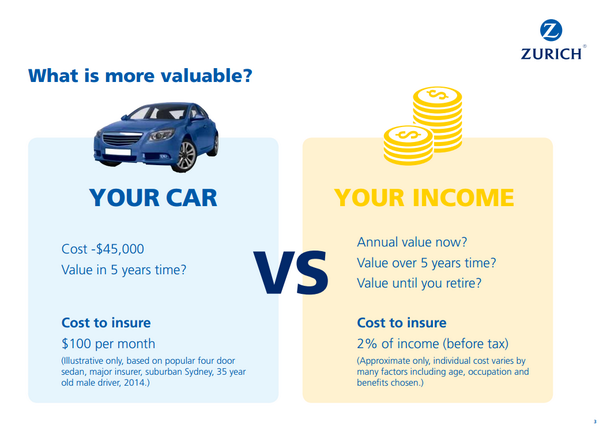

Image: silvanridge.com.au

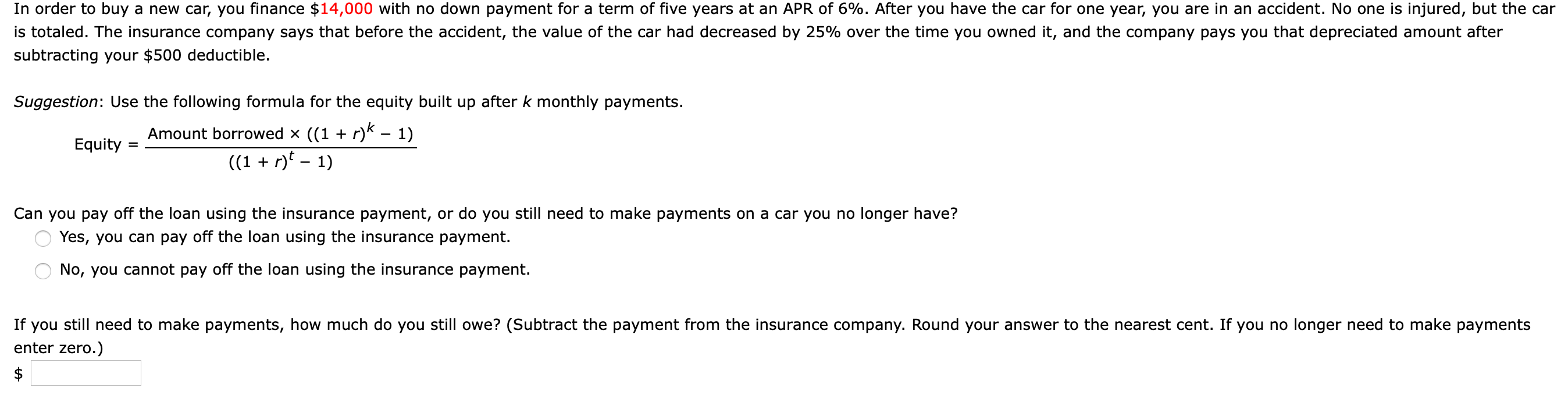

Image: www.chegg.com

Tax Benefits When Car is Provided by Employer to Employee Since you’re buying a car, you probably have a driver’s license. A passport or other government-issued photo ID will do the job, too. Learn about if you need a license to buy a car. Income: Current pay stubs often provide proof of income for car loans. But do you need pay stubs for an auto loan?